XTB (X-Trade Brokers) is a European brokerage house that offers derivatives trading.

- Powerful trading platform

- Great educational and analytical materials

- The lowest forex spreads

- Fast customer service

- Absence of guaranteed stop loss

- Non-forex spread costs are quite high

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76-83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XTB Broker has revolutionised online trading with its cutting-edge offerings, and we’re here to give you an exclusive insider’s look into what makes this platform a game-changer in the world of finance. In an era where precision, speed, and accessibility can make all the difference, XTB stands out as a beacon of innovation and reliability. We have prepared this guide to shed light on XTB’s features, benefits, and everything you need to know to thrive in the dynamic world of online trading. Whether you’re a seasoned pro or just starting your trading adventure, this XTB trading review will help you make informed trading decisions.

Our Opinion About XTB

According to our research and XTB reviews by industry professionals, XTB is an excellent broker and one of our favourites. The broker is well-regulated and in possession of numerous global licences, which underscores its commitment to maintaining high standards of financial integrity and security.

One standout feature we observed is XTB’s competitive spreads, which are notably low and present an advantage for traders looking to optimise their profit potential. What’s particularly appealing is that these spreads are often offered without or with minimal transaction costs, allowing traders to retain more of their earnings.

Furthermore, XTB’s flexibility shines through with its absence of a minimum investment requirement. Investors can initiate their trading journey with as little as $1, making it an inclusive platform accessible to traders with varying levels of capital.

However, it’s essential to note that there are a couple of areas where XTB could improve. Some traders may find it disappointing that XTB does not offer the widely popular MetaTrader 4 (MT4) platform, which is favoured by many in the trading community for its robust features and versatility.

Additionally, while XTB’s online trading platform provides excellent customer support, the availability of 24-hour support may vary depending on your location. This limited support window can be a drawback for traders who require immediate assistance at any hour of the day.

We were also impressed with the fact that XTB offers its clients the opportunity to earn interest on uninvested funds. You can earn up to 5% interest, with rates of 3.8% for EUR and 5.0% for USD on your uninvested balances, adding a potential passive income stream to your overall portfolio.

What We Like

- No Minimum Deposit Requirement: XTB’s commitment to accessibility is commendable. They allow traders to get started with as little as £1, making it an attractive choice for those with limited capital.

- Wide Range of Assets: XTB provides access to a diverse array of financial instruments, including over 5,800 CFD assets, making it suitable for traders with different preferences and strategies.

- Quality Research Tools: The platform offers a wealth of research materials, helping traders make informed decisions. From market analysis to educational resources, XTB equips its users for success.

- Responsive Customer Service: XTB stands out with its attentive and responsive customer support team, available through email, live chat, and phone.

- User-Friendly Interfaces: Whether on desktop or mobile, XTB offers intuitive, customisable platforms that cater to both beginners and experienced traders.

What We Don’t

- Withdrawal Fees: XTB imposes fees for withdrawing funds, below £50. These fees can eat into your profits.

- Inactivity Fee: After 12 months of inactivity, XTB charges an inactivity fee of £10. This fee can be a deterrent for traders who aren’t consistently active.

- Limited Support Service Hours: While XTB offers responsive customer support, it operates only five days a week, which may not be convenient for traders who require assistance 24/7.

XTB In-Depth

XTB offers a £0 minimum deposit, welcoming traders of all levels. Regulated by the FCA and KNF, it guarantees a secure journey. xStation 5 and xStation Mobile are advanced platforms for confident trading. Enjoy commission-free stock trading and responsive customer support via email, live chat, and phone. Stay connected with the mobile app for Android and iOS. Discover XTB’s unique features in the table below, making it the platform for innovative traders.

| Feature | Availability |

|---|---|

| Minimum Deposit Requirement | £0 |

| Licences | FCA, DFSA, FSC, KNF |

| Demo Account | Yes |

| Advanced Platforms | xStation 5, xStation Mobile |

| Trading Securities | Forex, shares, indices, commodities, cryptocurrencies, ETFs |

| Support Service | Email, live chat, phone |

| Mobile App | Android, iOS |

| Stock Investment Cost | Commission-free |

Security

When it comes to the safety of your investments, XTB takes security to the highest level of seriousness. This commitment is evident through its multiple licenses obtained from renowned regulatory bodies, including the Financial Conduct Authority (FCA), DFSA, FSC, and the Komisja Nadzoru Finansowego (KNF) in Poland. These regulatory endorsements are not mere formalities; they are powerful assurances of XTB’s dedication to ensuring the utmost security for its traders’ funds.

XTB also employs state-of-the-art encryption technologies to shield your sensitive data and transactions from potential threats. This includes the use of SSL encryption protocols, which are the industry standard for safeguarding online financial transactions. With SSL in place, all data exchanged between your browser and XTB’s servers is encrypted, rendering it virtually impenetrable to malicious actors. In light of XTB’s comprehensive approach to security, including multiple regulatory licenses and advanced encryption measures, we confidently award it a top-tier rating of 4.9 out of 5 in this category.

Platform and Account Types

XTB offers user-friendly and highly customisable trading platforms, including the versatile xStation 5 and the mobile-friendly xStation Mobile. xStation 5 provides an intuitive design suitable for traders with various preferences. Whether you’re into in-depth charting or a simplified interface, it has you covered. With a range of robust charting tools and technical indicators, it empowers traders to make informed decisions and execute trades swiftly.

For those on the move, xStation Mobile ensures seamless access via Android and iOS devices. It maintains a user-friendly experience while offering essential features, enabling traders to stay connected and trade effectively.

To accommodate diverse trading styles and needs, XTB offers standard, swap-free, and demo accounts. This versatility underscores XTB’s commitment to providing traders with the flexibility and tools needed for success in the dynamic world of financial markets. We therefore give it a 4.4-star rating.

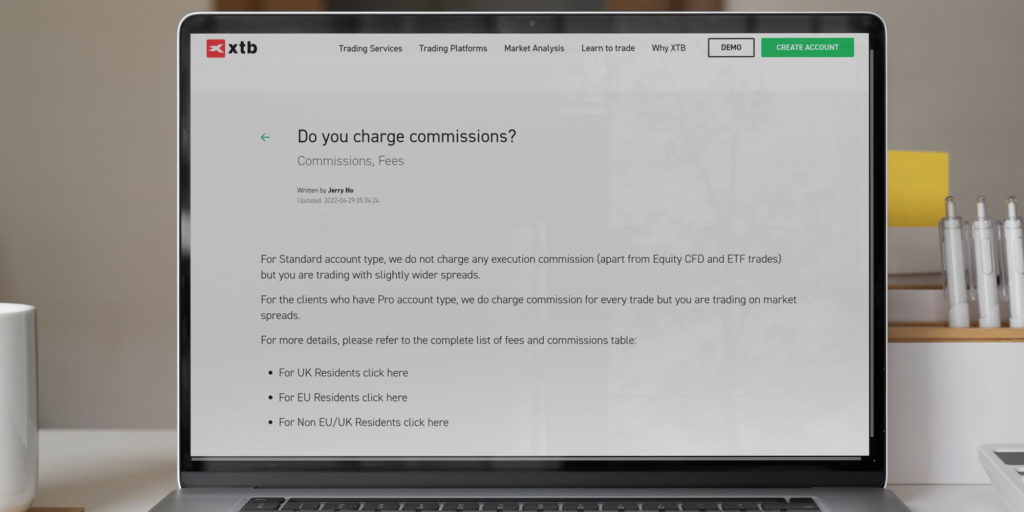

Fees

Like any other broker, XTB has a fee structure that traders should be mindful of. While the broker does not charge deposit or withdrawal fees as a standard practice, note that fees may apply, especially when using e-wallets for these transactions. The exact fees can vary based on the e-wallet service you choose. Plus, XTB has an inactivity fee policy. Here, users incur £10 per month after 12 months of account inactivity.

Another element we like about XTB is the opportunity for users to earn interest on their uninvested funds. There is no balance limit to qualify, and you can earn up to 5.2% interest annually on your uninvested GBP cash balance. Individuals with EUR and USD balances also have an opportunity to earn 3.8% and 5.0% interest on their cash balances, respectively. The best part is that XTB calculates this interest daily and deposits it to your account every month. This allows you to invest only whenever you identify a potentially profitable opportunity. Your uninvested funds will bring extra income.

When it comes to overnight fees, XTB imposes charges depending on the specific financial instrument you and the position held overnight. Traders should consider these charges when planning long-term positions. Margin rates also vary by asset and user type, impacting the available leverage for trades. With spreads from 0.1 pips, XTB has one of the lowest trading charges. We, therefore, rate its fee structure with 4.0 stars.

| Type | Fee |

|---|---|

| Deposit | £0 |

| Withdrawal | Yes, for withdrawals below 50 GBP |

| Inactivity | £10 monthly |

| Overnight Charges | – |

| Margin Rate | From 5% |

Additionally, XTB offers competitive interest rates on uninvested funds, providing an avenue for traders to potentially earn passive income. With rates of up to 5%, including 3.8% for EUR and 5.0% for USD on uninvested balances, XTB allows traders the opportunity to capitalise on idle funds while navigating the financial markets.

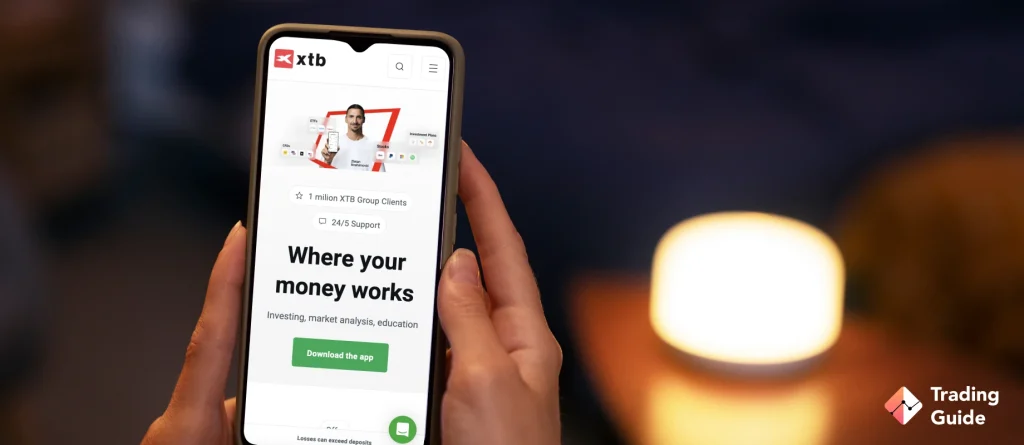

Mobile Compatibility

XTB recognises the significance of mobile compatibility in the modern trading landscape. The broker offers a dedicated mobile app that is compatible with both Android and iOS devices, ensuring traders can access their accounts and seize market opportunities while on the go.

The XTB mobile app is designed with user-friendliness in mind. Traders can experience a seamless and intuitive interface that allows for easy navigation through various features and swift trade execution with just a few taps on their mobile devices. This mobile platform provides access to real-time market data, customisable watchlists, and interactive charts, all essential tools for making informed trading decisions. Based on our XTB review and experience, we rank the broker’s mobile compatibility with 4.6 stars.

Product Offerings

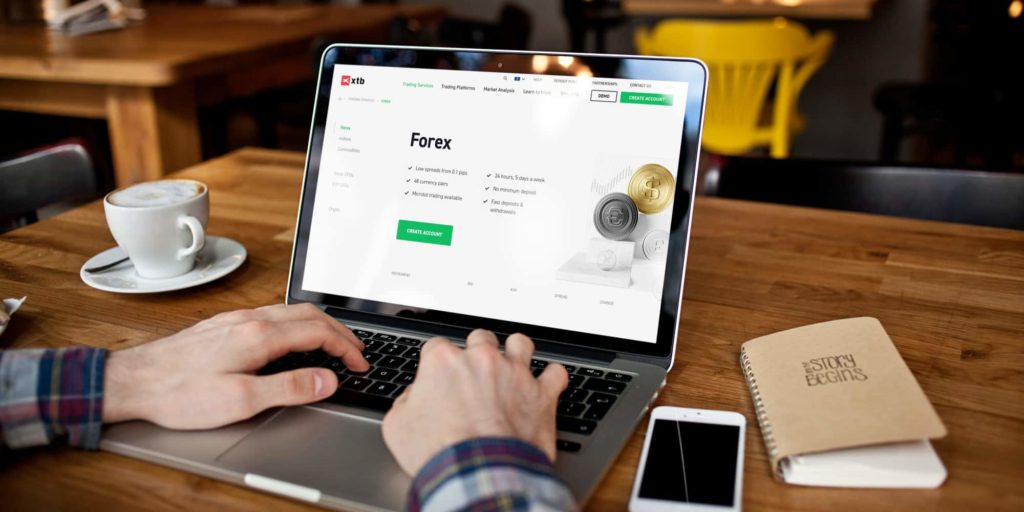

One of the standout features of XTB is its extensive range of product offerings, providing traders with a wealth of opportunities for diversification and strategic trading. The broker boasts a vast selection of over 5,800 CFD assets across various asset classes. Here’s a closer look at the array of assets we came across at XTB.

- Forex: XTB provides access to the dynamic and highly liquid forex market, offering traders the chance to trade over 70 currency pairs. This includes major, minor, and exotic currency pairs, catering to traders with varying risk appetites and trading strategies.

- Shares: Traders will explore over 3,400 stock CFD assets. These include shares from global markets, enabling traders to engage in equity trading and take advantage of opportunities in both established and emerging companies.

- Indices: The broker features a comprehensive range of indices CFDs, allowing traders to track the performance of stock market indices from around the world. This offers exposure to broader market trends and economic indicators.

- Commodities: XTB offers access to the commodities market, with 20 CFD instruments available. Traders can explore trading opportunities in precious metals like gold and silver, energy commodities such as oil, agricultural products, and more.

- Cryptocurrencies: XTB provides access to the exciting world of cryptocurrencies, offering CFDs on various digital tokens. Traders can speculate on the price movements of cryptocurrencies like Bitcoin, Ethereum, and others, without the need for a crypto wallet.

- ETFs: XTB facilitates the trading of ETF CFDs, giving traders exposure to diversified portfolios of assets. ETFs offer a convenient way to invest in a collection of assets, including stocks, bonds, and commodities.

Note that cryptocurrency CFDs are not accessible to retail traders through the XTB UK entity, and this restriction also applies to UK residents. Compared to many brokers we’ve reviewed, XTB has limited asset offerings, especially for UK traders. Therefore, we leave it with a 3.6-star rating in this category.

Education Tools

XTB shines in the realm of trader education, offering a wealth of learning resources. We benefited from numerous articles, guides, eBooks, webinars, and more, thus leaving it with a 4.3-star rating in this category. Note that these educational materials are a treasure trove for traders seeking to expand their knowledge and hone their skills. Whether you’re a novice looking to grasp the fundamentals or a seasoned trader aiming to refine your strategies, XTB’s educational tools provide vital support, ensuring that traders are well-prepared to navigate the intricacies of financial markets.

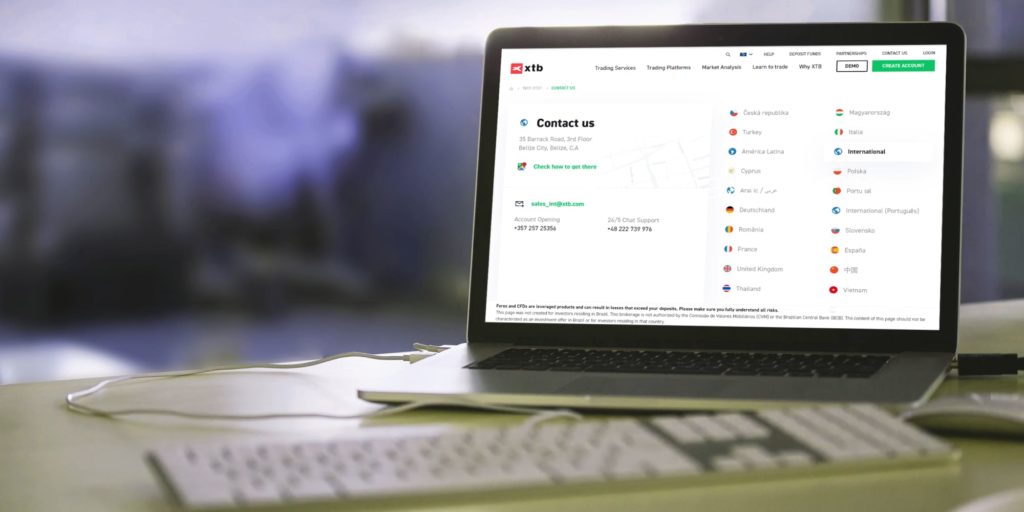

Customer Service

Based on our comprehensive testing, XTB distinguishes itself by offering exceptional customer support, characterised by prompt and relevant responses. The broker’s support team operates round the clock and provides assistance in multiple international languages through various channels. These include live chat, email, and dedicated phone lines servicing different regions, including the UK and international clientele.

However, it’s worth noting that XTB’s customer service is not available on weekends. During this period, you have the option to submit your queries via a contact form, and you will receive assistance in due course. For this reason, we give this broker’s support service a 3.9-star rating.

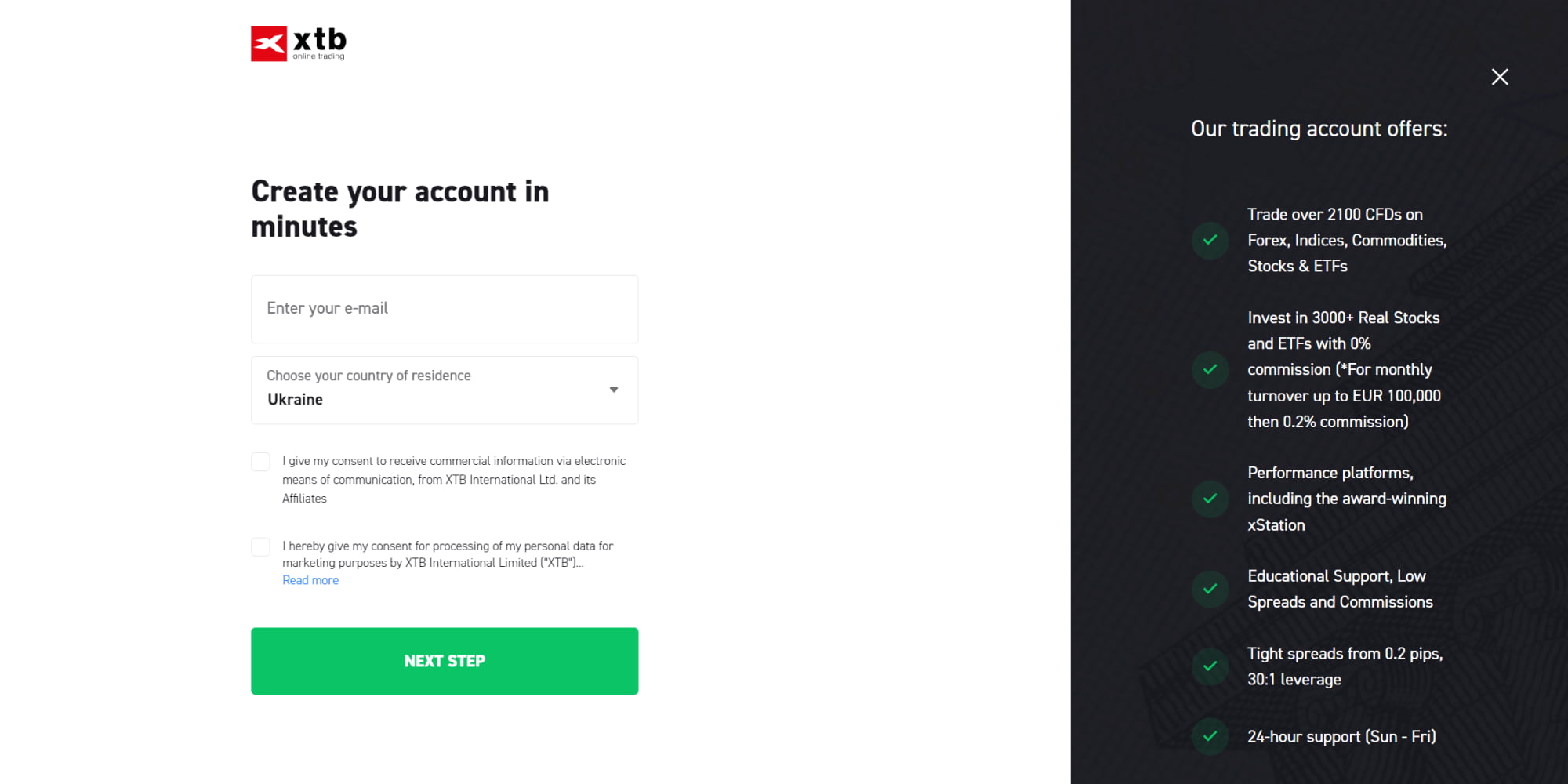

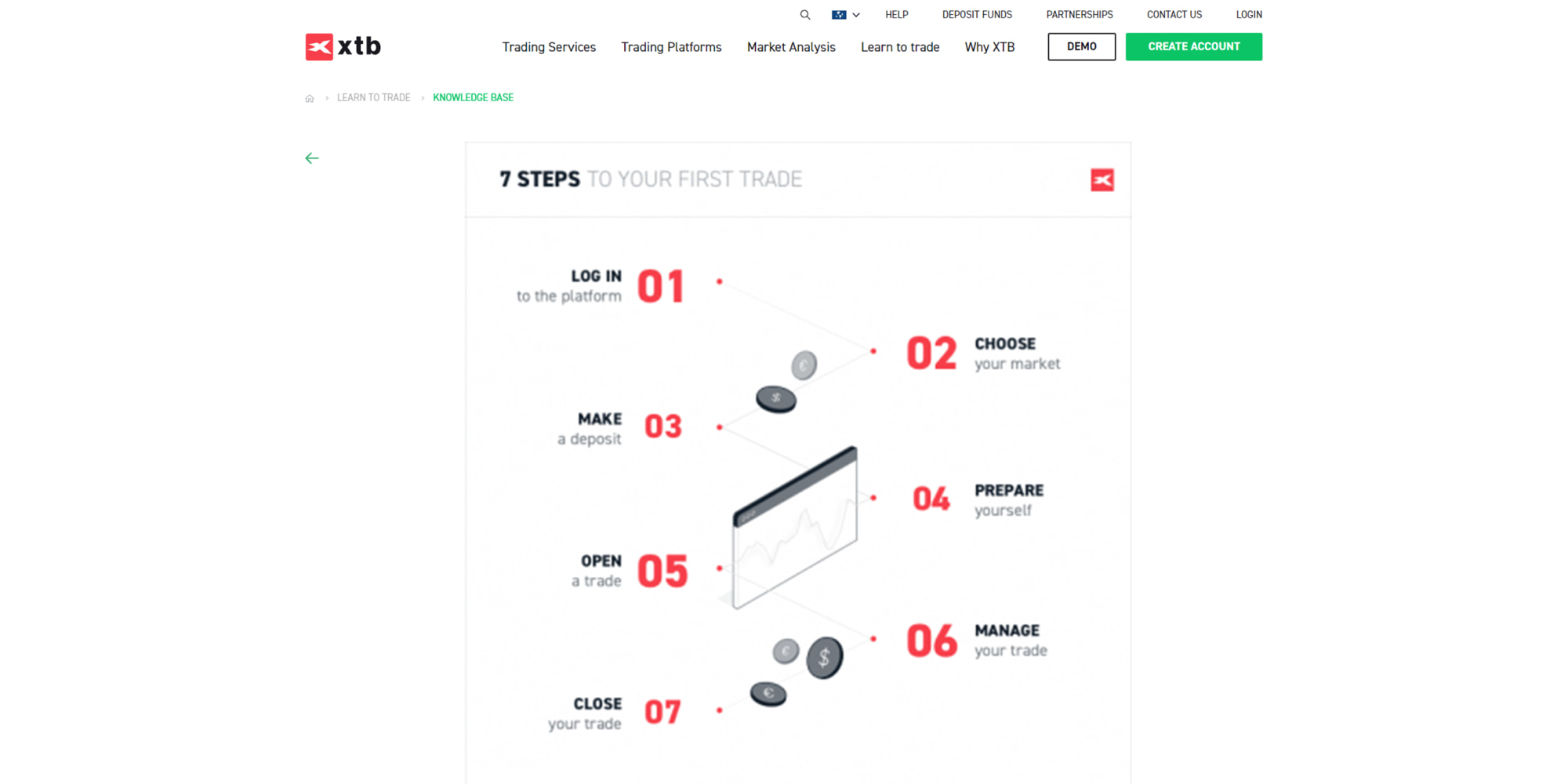

How to Sign Up For an Account at XTB

We strive to ensure our readers get accurate broker reviews. Therefore, we signed up for trading accounts at XTB and were impressed with our experience. The account sign-up process was straightforward, making us give it a 4.5-star rating in this category. If you have been looking for ways to get started, keep reading as we guide you through the procedures.

Navigate to the XTB website by clicking on any of the links we’ve shared on this page. Remember, always read,understand, and accept brokers’ terms and conditions before creating an account with them. And if you are always on the move, consider downloading XTB’s app on your mobile device for streamlined activities on the go.

On XTB’s site, click the “Create Account” button to begin the account setup process. You will be required to share your name, email address, phone number, source of income, and more. XTB also requires that you create a username and password for added security.

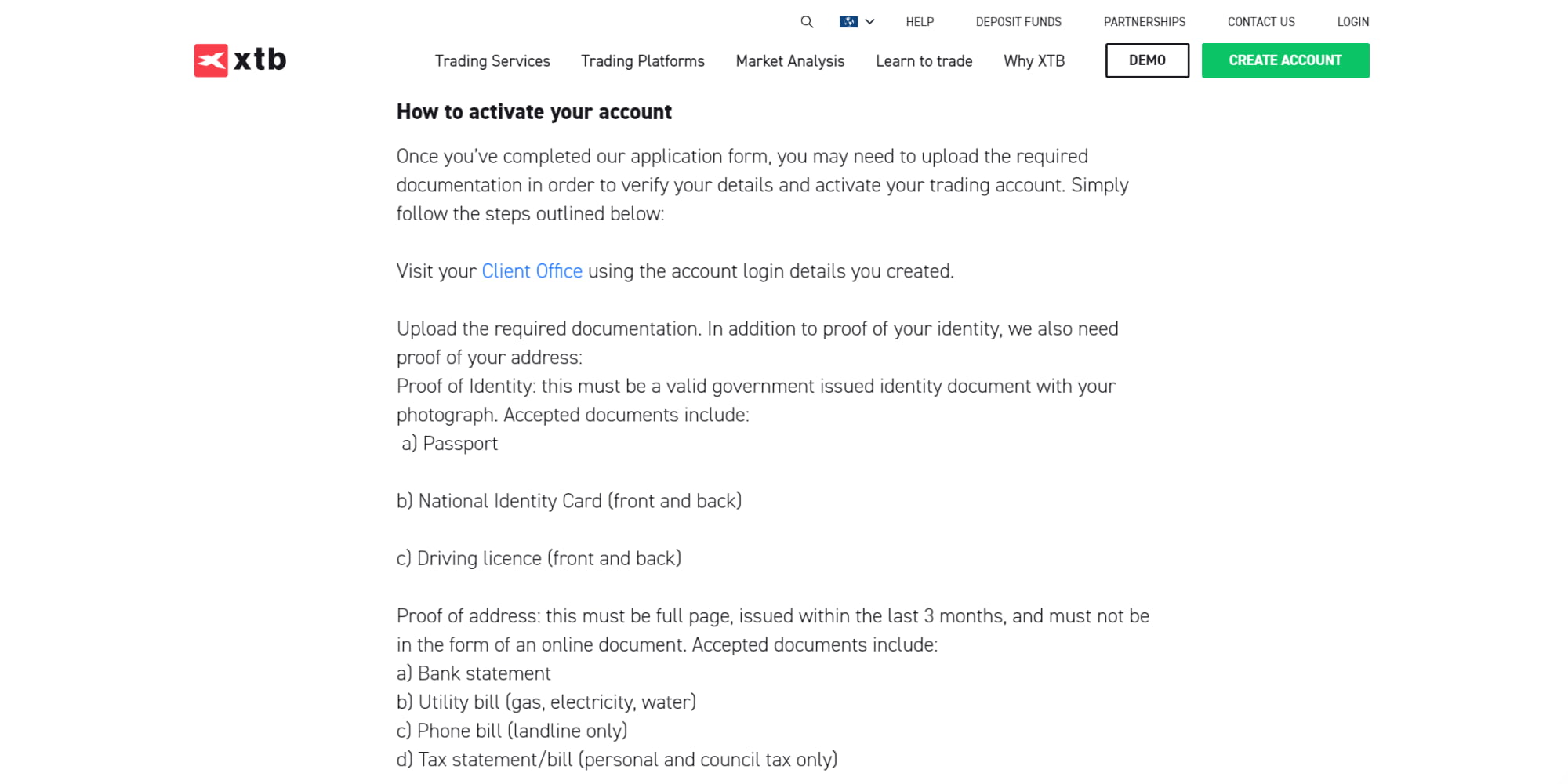

XTB will require you to verify your identity, which involves providing your Social Security number or Individual Taxpayer Identification Number. You can also share copies of your driver’s license or passport and a recent utility bill as proof of residence. Account verification is a standard protocol required by all brokers to keep away imposters or terrorists trying to access the stock market.

XTB will then fully activate your account after which you will be required to make a deposit and get started. Remember, the broker has no minimum deposit requirement, and you can transact using multiple options. These include credit/debit cards, e-wallets, and bank transfers.

Once your account is funded, you will automatically be redirected to where the assets are listed for trade. Remember, while CFD trading allows you to go long or short, losses are inevitable. Therefore, approach this trading method cautiously, especially when applying leverage, as this could leave you with massive losses.

Alternative to XTB

If XTB doesn’t fully align with your trading preferences, consider comparing it to other brokers to find the one that suits you best. Here’s a comparison table of some of the most relevant brokers.

| Broker | Minimum Deposit | Demo Account | Mobile App | Commission/Spread |

|---|---|---|---|---|

| Interactive Brokers | £0 | Yes | Yes | Yes |

| eToro* | £50 | Yes | Yes | Yes |

| OANDA | £0 | Yes | Yes | Yes |

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Is XTB Good For You?

XTB is a reputable broker with many strengths, including no minimum deposit requirement, a wide range of assets, quality research tools, and responsive customer service. However, it’s essential to be aware of the trading charges, deposit and withdrawal fees, and inactivity fees associated with the platform. Whether XTB is a good fit for you depends on your trading style, budget, and specific preferences. Carefully evaluate the pros and cons outlined in this review to determine if XTB aligns with your financial goals and trading strategy.

FAQs

No. While XTB can be used for long-term investing, it is best suited to short-term investors who want to trade Forex and CFDs. You can trade CFDs on numerous assets, including stocks, cryptocurrency, and commodities.

No. XTB does not allow you to invest directly in Bitcoin or another cryptocurrency. However, the broker lets you speculate on cryptocurrency price movements through CFDs (contracts for difference). XTB offers 40+ crypto CFDs, including Bitcoin, Ethereum, Stellar, and Dogecoin.

Opening an XTB account is quite straightforward. First, go to the XTB website or download the xStation mobile app to begin the account opening process. Click the “Create Account” button and register your email and password.

Confirm your email, then fill in your personal information (including name, birth date, and country of residence). Next, select the base currency of your account.

To gain full access to your XTB account and start trading, the broker will require you to submit a copy of your ID and a bank statement or recent utility bill to verify your identity and address. Once XTB approves your application, you can log in and fund your account.

Absolutely. XTB is a user-friendly broker with a pretty straightforward account registration process. It has an excellent selection of educational materials, including an extensive video library that you can utilise to maximise your experience and potential. Furthermore, XTB offers a demo account that beginners can use to practise before investing real money.

XTB (X-Trade Brokers) is a European brokerage house that was founded in 2002 in Warsaw, Poland. The company has several offices worldwide, including XTB Limited, which is based in London, UK, and is regulated by the Financial Conduct Authority. Moreover, XTB is now widely distributed in more than 15 countries in Europe, South America and Asia.

XTB Review Details

*Note, payment methods depend on the country of registration.

Never tried XTB but I know they have a wide range of markets. I use Pepperstone and FXTM for their tight spread size, low account minimums, and low trading commissions that help me save my profits.

I think you can try XTB, because it is really reliable broker. When choosing a new broker for the trade you need to look at some main thing. For one, a broker must be regulated and registered under the relevant financial agencies in your jurisdiction. In addition, they should provide support in terms of Forex education, analysis, demos, and live trading. They should also have robust and user-friendly trading platforms that doesn’t freeze when you really need to place your trades.

You can try this. XTB offers traders outstanding customer service and an excellent trading experience overall thanks to the trading platform.

this broker makes it easy for me to trade etfs

it is easy for me to make money with xtb

I don't know if this broker is a good, I almost had open account in XTB, but after reading a few reviews, a lot people complain about, actual this broker seem kind of popular and genuine trust with, have a very good webpage and all, it seems 100% legit! if lot people feels scam by this broker, how comes it still legally and operating after a lot of year of existence, kind of strange in my opinion, but I still got my doubts. Need to be wise when choosing brokers.

I am doing Forex trading with XTB with deposit £1000. I work mainly on intraday with major pairs. Sometimes use new instruments too. I usually raise profit around £250 a month, but one time it was £723! I withdraw to my bank card, money enroll quickly. No remarks on trade.

The broker works without commissions, which is very nice. And here, the shares, already with the commission, and not a small one. Be careful! Support on high. The speed of withdrawal depends on many factors, and not necessarily on the sluggishness of the broker. Do not take a crazy commission from the shares and will be super.

I have been a customer of the platform in Poland for two years now, and my experience has been unequivocally positive. All issues that arose along the way were successfully resolved in a matter of hours, and at the moment I feel comfortable in a partnership with the XTB team. I'm satisfied and definitely recommend it!

I used XTB for 6 month and whenever I needed support I received it. In other ways, regarding the usability of the platform, I could say that it is ok, easy to use because of the tutorials and materials you can find on the internet.

I have been trading for 4 years and have had 13 broker accounts, so I have a good range of comparisons. Xtb is good because of their customer services and an account manager that always meets your needs. One of the very best for me in the UK

XTB is a great broker. It's great that they allow you to open micro-lot positions, especially if you're learning and want to try different strategies.

Everything works fine, and most importantly simple. Funds come quickly, it is possible to try out the demo version.

XTB is very helpful and friendly. The reason I like to be with XTB is everything I have leant about trading is through XTB their webinars, trading clubs and Master Classes and I have been educated for free which these days are pretty lucky. I wanna say that I can recommend XTB to anybody thinking of starting to trade.

I've been trading for a short period of time. But I think the broker team are skilled professional workers and dedicated to encouraging successful outcomes for their clients. They have many study materials for free and much more after registration (also for free). They should keep this level of service.

I recently became a client with XTB. The process of verifying my account went really fast. They have a good leverage of 200:1. I recommend it to everyone at my workplace!

XTB is a great broker. Very strong platform much better than MT4/MT5. The web xstation is beautiful to use. Deposit and withdrawal money is very simple. Great customer support, thank you.

The educational materials were extremely useful, and accessible, delivered by knowledgeable and friendly traders who were happy to answer any questions. Very simple deposit and withdrawal procedure.

Simple, clear and very well designed mobile application. Good service, withdrawal is good, received funds both on my dollar account and peso account. Customer support is good, responding to email quickly. The platform is good, very easy to use, they keep on updating.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

XTB is that rare broker that actually gets better the more you dig into it.